Lesson 6: Foreign Aid

ECON 317 · Economics of Development · Fall 2019

Ryan Safner

Assistant Professor of Economics

safner@hood.edu

ryansafner/devf19

devF19.classes.ryansafner.com

Aid for Growth

We restrict our exploration to foreign aid for the purpose of causing economic growth/development

NOT aid for humanitarian crises or natural disaster recovery

NOT aid for military/peacekeeping efforts

NOT aid for specific causes (i.e. reduce malaria)

- Note these might be related to economic growth!

Foreign Aid: A Timeline I

1940s-1950s: World War II ends

1945-1951: Marshall Plan to rebuild war-torn Europe

1946: Harrod-Domar model -> "financing gap"

Foreign Aid: A Timeline II

1950s-1960s:

1960 Rostow's stages of growth model

Cold War starts, "Red scare" in U.S.

Foreign aid to "Third World" takes off, in part to protect it from Soviets

The Invention of "Development" and Foreign Aid

John F. Kennedy addressing USAID

"There is no escaping our obligations: our moral obligations as a wise leader and good neighbor in the interdependent community of free nations – our economic obligations as the wealthiest people in a world of largely poor people, as a nation no longer dependent upon the loans from abroad that once helped us develop our own economy – and our political obligations as the single largest counter to the adversaries of freedom." – John F. Kennedy

- Foreign Assistance Act of 1961 creates U.S. Agency for International Development (USAID)

Source: USAID

Foreign Aid: A Timeline III

- Before 1980s:

- Protectionist trade-policies

- Import-substitution industrialization

La Decada Perdida

1982: Mexico announces it can no longer finance its debts

1980s Latin American debt crisis

Also in Africa and Middle East

1980s: The Rise of Structural Adjustment Lending

IMF and World Bank begin to make general loans (instead of for specific projects) to developing countries, conditional on "structural adjustment"

Governments would be required to make growth-enhancing policy changes in exchange for loans

What were these? Eventually became known as...

1990s: The Washington Consensus

Rodrik, Dani, 2006, "Goodbye Washington Consensus, Hello Washington Confusion?" Journal of Economic Literature 44(4): 973-987

Criticism of IMF, SAL, and Washington Consensus

Foreign Aid Today III

Foreign Aid Today IV

- 57% of American voters believe we give too much foreign aid (2017) Source: Rasmussen Reports

- 6% say it's not enough

27% say it's about right

Foreign aid is less than 1% of our federal spending

Foreign Aid Today V

The Theoretical Foundations of Foreign Aid

The Harrod-Domar Model I

L: Roy Harrod (1900-1978)

R: Evsey Domar (1914-1997)

"Knife's Edge equilibrium: a single savings rate and ICOR that permits stable growth

- Growth too low ⟹ depression

- Growth too high ⟹ hyperinflation

Highly simplistic, yet extremely influential

- Focus on unconsumed surplus to be used for investment

- GDP growth rate ∝ Investment share of GDP

- Tendency to think "Development" = Growth = Industrialization

- Ripe for Development planning from above

The Harrod-Domar Model II

L: Roy Harrod (1900-1978)

R: Evsey Domar (1914-1997)

"Financing gap" between "required" investment rate (from model) and a country's actual saving rate

Low income countries can't increase savings ⟹ foreign aid from countries with higher savings will lead directly to rapid growth1

1 Remember this argument!

The Poverty Trap Argument

Poverty trap argument:

In order to escape poverty, people must invest in capital goods to improve productivity

In order to invest, people must first save some of their income

Low-income people need to spend all of their income on subsistence

Thus, they are trapped in a poverty trap

Assessing the Effectiveness of Foreign Aid for Growth

It Wasn't.

Assessing the Effectiveness of Foreign Aid for Growth I

Easterly, William, 2010, The Elusive Quest for Growth: Economists Adventures and Misadventures in the Tropics Cambridge: MIT Press

Assessing the Effectiveness of Foreign Aid for Growth II

William Easterly

1957-

"Between 1950 and 1995, Western countries gave $1 trillion (measured in 1985 dollars) in aid. Since virtually all of the aid advocates used the financing gap approach, this was one of the largest policy experiments ever based on a single economic theory," (p.33).

Structural Adjustment Lending

William Easterly

1957-

"The World Bank and IMF pursued the ambitious hope of achieving "adjustment with growth" through intensive involvement with typical recipients. In the 1980s, the World Bank and IMF gave an average of six adjustment loans to each country in Africa, an average of five adjustment loans to each country in Latin America, an average of four adjustment loans to each country in Asia, and an average of three adjustment loans to each country in Eastern Europe, North Africa, and the Middle East," (p.102).

Structural Adjustment Lending

William Easterly

1957-

"The operation was a success for everyone except the patient. There was much lending, little adjustment, and little growth in the 1980s and 1990s." (pp.102-3).

"A later study showed that World Bank predictions overestimated long-run growth in adjustment lending recipients by 3.5 percentage points. The per capita growth rate of the typical developing country between 1980 and 1998 was zero. The lending was there, but the growth wasn't," (p. 103).

Assessing the Effectiveness of Foreign Aid for Growth III

Easterly, William, 2010, The Elusive Quest for Growth: Economists Adventures and Misadventures in the Tropics Cambridge: MIT Press

Aid's Proponents I

Jeffrey D Sachs

1954-

"I have long believed in foreign aid as one tool of economic development...the recent evidence shows that development aid, when properly designed and delivered, works, saving the lives of the poor and helping to promote economic growth."

"As experience demonstrates, it is possible to use our reason, management know-how, technology, and learning by doing to design highly effective aid programs that save lives and promote development. This should be done in global collaboration with national and local communities, taking local circumstances into account. The evidence bears out this approach."

Aid's Proponents I

Jeffrey D Sachs

1954-

"Of course, I do not believe that aid is the sole or main driver of economic development. I do not believe that aid is automatically effective. Nor should we condone bad governance in Africa — or in Washington, for that matter. Aid is one development tool among several; it works best in conjunction with sound economic policies, transparency, good governance, and the effective deployment of new technologies."

Aid's Proponents II

Jeffrey D Sachs

1954-

Across the board, the post-2000 improvements in public health in sub-Saharan Africa have been dramatic, strongly supported by scaled-up aid. Up to 10 million HIV-infected individuals are now receiving life-saving, anti-retroviral medicines thanks at least in part to aid programs. Tuberculosis (TB) patients are being treated and cured, with a global TB mortality rate drop of 45 percent since 1990, and an estimated 22 million people alive due to TB care and control from 1995-2012, thanks to Global Fund support, which provides the lion’s share of donor financing to fight TB. With increased donor support, antenatal health visits, institutional deliveries, and access to emergency obstetrical care are all on the increase, contributing to a decline in sub-Saharan Africa’s maternal mortality rate (the annual number of female deaths per 100,000 live births) from 850 in 1990 to 740 in 2000 to 500 in 2010. Deaths of children under five worldwide have declined from 12.6 million a year in 1990 and 10.8 million in 2000 to 6.5 million in 2012."

Aid's Proponents II

Jeffrey D Sachs

1954-

These successes demonstrate a key lesson: that well-designed aid programs with sound operating principles, including clear goals, metrics, milestones, deliverables, and financing streams, can make an enormous difference, and that such programs should be devised and applied on a large scale in order to benefit as many people as possible. Such quality design needs to be based on the details of best practices, such as the combination of medicines, bed nets, and diagnostics used in cutting-edge, community-based malaria control."

Aid's Proponents II

Aid's Proponents III

Digression: Growth Regressions

Growth Regressions

Development papers are very empirical

Take data (of varying quality) from countries around the world and try to see:

What factors explain variation in GDP per capita around the world?

Dependent variable: GDP per capita (or growth rate)

Independent variables: things that can plausibly affect GDP per capita

Linear Regression

Y=a+bX

Linear regression is the process of fitting a line to data

- a: intercept (Y when X=0)

- b: slope, ΔYΔX

This is idea of a "line through data points" is just to give you intuition

- Lines can be curves

- More than one X variable...MANY X variables

- More advanced methods and models

If you want to know more, take my econometrics class

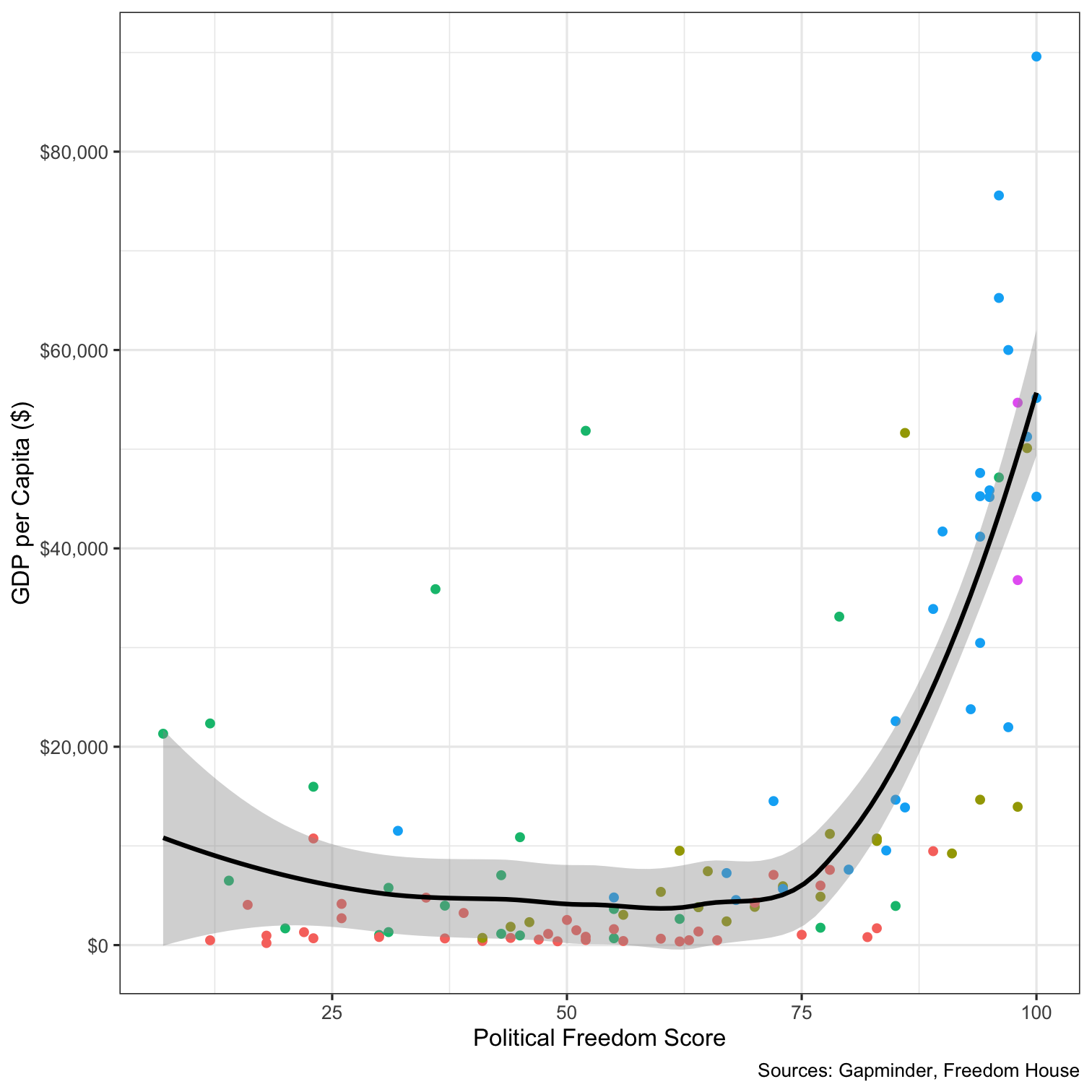

What are Good Independent Variables? I

Previous GDP per Capita

Investment share of GDP

Macroeconomic variables

Foreign Aid

Geography

Culture

Political institutions

What are Good Independent Variables? II

Recall we are limited by the data we can find and measure

A lot of variables used are proxy variables that are correlated with something we care about, but can't measure

- Inflation rate

- Ethnolinguistic fractionalization

- Region dummy variables

- "Black market premium on foreign exchange"

- Polity IV index of political institutions

"Kitchen-Sink" Regressions

Burnside and Dollar (2000: 852)

Burnside, Craig and David Dollar, 2000, "Aid, Policies, and Growth," American Economic Review 90(4): 847-868

"Kitchen-Sink" Regressions

GDP per capita growth=β0+β1Initial GDP+β2+Ethnic fractionalization+β3Assassinations+⋯

How to Read a Regression Table I

Each column is a particular model

Number next to each variable (row) is the marginal effect of that variable on outcome variable

- Holding other included variables constant

- A 1 unit change in that variable ⟹ a (that number) change in outcome variable

Number in parentheses below it is the standard error of the estimate

- If it is less than half of the estimate, statistically significant

Burnside, Craig and David Dollar, 2000, "Aid, Policies, and Growth," American Economic Review 90(4): 847-868

How to Read a Regression Table II

- R2: goodness of fit of regression

- Percent of overall variation in outcome explained by the model

- Higher is better (and rarer in the real world)

Burnside, Craig and David Dollar, 2000, "Aid, Policies, and Growth," American Economic Review 90(4): 847-868

Burnside and Dollar (2000): Aid, Policies, and Growth

"We find that aid has a positive impact on growth in developing countries with goodfiscal, monetary, and trade policies but has little effect in the presence of poor policies. Good policies are ones that are themselves importantfor growth. The quality of policy has only a small impact on the allocation of aid. Our results suggest that aid would be more effective if it were more systematically conditioned on good policy," (p.847)

Burnside, Craig and David Dollar, 2000, "Aid, Policies, and Growth," American Economic Review 90(4): 847-868

Easterly, Levine, and Roodman (2003): Comment I

"The Burnside and Dollar (2000, AER) finding that aid raises growth in a good policy environment has had an important influence on policy and academic debates. We conduct a data gathering exercise that updates their data from 1970 -93 to 1970 -97, as well as filling in missing data for the original period 1970 -93. We find that the Burnside and Dollar (2002, AER) finding is not robust to the use of this additional data," (p.1).

Easterly, William, Ross Levine, and David Roodman, 2003, "New Data, New Doubts: A Comment on Burnside and Dollar’s “Aid, Policies, and Growth” (2000)," NBER Working Paper 9846

Easterly, Levine, and Roodman (2003): Comment II

Easterly, William, Ross Levine, and David Roodman, 2003, "New Data, New Doubts: A Comment on Burnside and Dollar’s “Aid, Policies, and Growth” (2000)," NBER Working Paper 9846

Ovaska (2003): The Failure of Development Aid I

"Contrary to some previous findings in the development aid literature, the results from the fixed effect (FE) model with group dummy variables and period effects indicated a negative relationship between development aid and economic growth. In particular, it was found that a 1 percent increase in aid as a percent of GDP decreased annual real GDP per capita growth by 3.65 percent," (p.186).

Ovaska, Tomi, 2003, "The Failure of Development Aid," Cato Journal 23(2): 175-188

Ovaska (2003): The Failure of Development Aid II

Ovaska, Tomi, 2003, "The Failure of Development Aid," Cato Journal 23(2): 175-188

Djankov et. al (2008): The Curse of Aid I

"Foreign aid provides a windfall of resources to recipient countries and may result in the same rent seeking behavior as documented in the "curse of natural resources" literature. In this paper we discuss this effect and document its magnitude. Using panel data for 108 recipient countries in the period 1960-1999, we find that foreign aid has a negative impact on institutions. In particular, if the foreign aid over GDP that a country receives over a period of 5 years reaches the 75th percentile in the sample, then a 10-point index of democracy is reduced between 0.5 and almost one point, a large effect. For comparison, we also measure the effect of oil rents on political institutions. We find that aid is a bigger curse than oil," (p.169).

Djankov, Simeon, Jose G Montalvo, and Marta Reynal-Querol, 2008, "The Curse of Aid," Journal of Economic Growth 13(3): 169-194

Foreign Aid and Incentives

Foreign Aid and Incentives

The Incentives of Foreign Aid

P. T. Bauer

1915-2002

"[Foreign aid is] an excellent method for transferring money from poor people in rich countries to rich people in poor countries."

Bauer, Peter, 2000, "From Subsistence to Exchange," in Bauer, P. T., From Subsistence to Exchange, and Other Essays, Princeton University Press

Foreign Aid and Incentives I

Incentives for Donors/Lenders

- want to help the poor

- cannot credibly cut funding

- political optics

- constituents

Incentives for Recipient governments:

- Know donors cannot cut off funding credibly

- Higher poverty countries get more aid

- little incentive to actually reduce poverty

Structural Adjustment Lending and Incentives I

IMF/World Bank tied lending to structural change and policy improvements

Recipient countries found clever ways to pretend it looked like they were adjusting their policies

Cut present spending (on infrastructure, healthcare, etc) to lower budget deficit

Extract more resources (esp. oil) faster today to get a one time boost in numbers (at risk of depleting future resources)

Structural Adjustment Lending and Incentives II

William Easterly

1957-

"A government that was irresponsible before the adjustment loan has unchanged incentives to be irresponsible after the adjustment loan. Only a change from a bad government to a good government will truly change policies. An unchanged irresponsible government will create the illusion of adjustment without doing the real thing. Even when donors enforce the reductions in the budget deficit, fore example, the irresponsible government has every incentive to do creative fiscal accounting to avoid real adjustment," (p. 111).

Structural Adjustment Lending and Incentives II

William Easterly

1957-

"Paradoxically, the poor in the recipient country will be better off if the aid disbursement decision is delegated to a hard-hearted agency that doesn't care about the poor. This Scrooge agency can credibly threaten to withhold aid if the recipient does not meet the conditions and alleviate poverty. The recipient will then meet the conditions, and the poor will benefit," (p. 116).

How The Politics of Foreign Aid Warps Our Thinking I

P. T. Bauer

1915-2002

"Disregard of reality promotes erosion of language, which promotes further disregard of reality...If a country is officially designated as democratic or as a people’s republic, we know that it is one in which people have no say in the government. Another category of examples is the treatment of countries and other collectivities as if they were single decision-making entities, or entities within which all the people have identical interests, experiences, and conditions. The aggregation of two-thirds of mankind as the Third World is a conspicuous example." (p.25)

Bauer, Peter, 2000, "From Subsistence to Exchange," in Bauer, P. T., From Subsistence to Exchange, and Other Essays, Princeton University Press

How The Politics of Foreign Aid Warps Our Thinking II

P. T. Bauer

1915-2002

"Time and again the guilt merchants envisage the Third World as an undifferentiated, passive entity, helplessly at the mercy of its environment and of the powerful West.

The exponents of Western guilt further patronize the Third World by sug- gesting that its economic fortunes past, present, and prospective, are deter- mined by the West; that past exploitation by the West explains Third World backwardness; that manipulation of international trade by the West and other forms of Western misconduct account for persistent poverty; that the economic future of the Third World depends largely on Western donations. According to this set of ideas, whatever happens to the Third World is largely our doing." (p.72)

Bauer, Peter, 2000, "From Subsistence to Exchange," in Bauer, P. T., From Subsistence to Exchange, and Other Essays, Princeton University Press

How The Politics of Foreign Aid Warps Our Thinking III

P. T. Bauer

1915-2002

"It is foreign aid which has brought into existence the Third World (also called the [Global] South) and which thus underlies the so-called North-South dialogue or confrontation. Foreign aid is a source of the North-South conflict, not its solution. Take away foreign aid, and there is no Third World or South as aggregate. A further pervasive consequence of aid has been to promote or exacerbate the politicisation of life in aid-receiving countries. These major results have been damaging to both the West and the peoples of the less developed world." (p.42)

Bauer, Peter, 2000, "From Subsistence to Exchange," in Bauer, P. T., From Subsistence to Exchange, and Other Essays, Princeton University Press

Investment and Remittances: "Private" Foreign Aid

Foreign Direct Investment I

Ludwig von Mises

(1881-1973)

"The greatest event in the history of the nineteenth century...was the development of foreign investment," (p. 407).

"Without capital investment, it would have been necessary for nations less developed than Great Britain to start with the methods and the technology with which the British had started in the beginning...of the eighteenth century, and slowly, step by step–always far below the technological level of the British economy-try to imitate what the British had done," (p.79).

von Mises, Ludwig, 1979, "Foreign Investment," Ch. 5 in Economic Policy

Foreign Direct Investment II

Ludwig von Mises

(1881-1973)

"Foreign investment meant that British capitalists invested British capital in other parts of the world. They first invested it in those European countries which, from the point of view of Great Britain, were short of capital and backward in their development. It is a well known fact that the railroads of most European countries, and also of the United States, were build with the aid of British capital...The gas companies of Europe were also British...In the same way, British capital developed...many branches of industry in the United States," (p.80-81).

von Mises, Ludwig, 1979, "Foreign Investment," Ch. 5 in Economic Policy

Foreign Direct Investment II

Ludwig von Mises

(1881-1973)

"And of course, as long as a country imports capital its balance of trade is what the noneconomists call “unfavorable.” This means that it has an excess of imports over exports...British factories sent many types of equipment to the United States, and this equpment was not paid for by anything other than shares of American corporations," (p.80).

"You must think of all those things that would not have come into being if there had not been any foreign investment. All the railroads, all the harbors, the factories and mines in Asia, and the Suez Canal and many other things in the Western Hemisphere, would not have been constructed had there been no foreign investment," (p.81).

von Mises, Ludwig, 1979, "Foreign Investment," Ch. 5 in Economic Policy

Remittances I

"The Pew Research Center keeps close tabs on remittances sent from the United States to people in other countries. In 2017, the last year for which Pew has complete data, those remittances totaled a whopping $148.5 billion. To put that number in perspective, U.S. Gross Domestic Product that year was $19.39 trillion. That means that remittances were 0.76 percent of GDP. By contrast, in 2017 the U.S. government’s spending on foreign aid, both in economic and military assistance, totaled $50.1 billion. That’s only about a third of individual remittances.

"Not surprisingly, the top 10 recipients of U.S. remittances in 2017 were all countries where the majority of people are poor by U.S. standards. Mexico led the list with receipts of $30 billion from the United States, followed by China ($16.1 billion), India ($11.7 billion), and the Philippines ($11.1 billion.)

"This demonstrates that remittances are a major form of foreign aid to people in poor countries."

Henderson, David, 2019, "Immigrant Remittances Are Private Foreign Aid," Hoover Institution

Remittances II

"Remittances sent to all countries in 2012 (developing and high income) was $534bn, three times greater than aid budgets to the developing world.

"In 2016, the World Bank expects remittances to reach over $600bn, with over $440bn being sent to developing countries"

World Bank, 2016,Migration and Remittances Factbook 2017, 3rd ed.

Microlending

"More than 1.7 billion people around the world are unbanked and can’t access the financial services they need. Kiva is an international nonprofit, founded in 2005 in San Francisco, with a mission to expand financial access to help underserved communities thrive.

"We do this by crowdfunding loans and unlocking capital for the underserved, improving the quality and cost of financial services, and addressing the underlying barriers to financial access around the world. Through Kiva's work, students can pay for tuition, women can start businesses, farmers are able to invest in equipment and families can afford needed emergency care."

What Can Aid Do? I

- Argument: developed countries have [X], let's supply [X] to developing countries so they can develop.

X =

- Schools

- Roads, bridges, dams

- Sewage systems

- Hospitals

- etc.

These are consequences of development, not necessarily causes!

![]()

What Can Aid Do? II

"Under normal conditions, devoting more resources to X's production produces more X...In principles of economics classes, it is common to highlight that this relationship has nothing to do with the economic problem. The economic problem asks how to produce X in the least-cost way, whether to produce more or less X, and indeed, whether to produce any X at all given the alternative uses of the inputs required to produce it.

"Solving the economic problem determines whether a country's economy develops. It is strange, then, that professional economists have had trouble distinguishing the positive relationship between inputs and outputs from solving the economic problem when it comes to evaluating foreign ," (p.391)

Skarbek, David and Peter T Leeson, 2009, "What Can Aid Do?" Cato Journal 29(3): 391-397

What Can Aid Do? III

"Foreign aid's advocates claim aid has been successful. Aid's critics claim aid has failed. We explain why both camps are correct. Aid can, and in a few cases has, increased a particular output by devoting more resources to its production. In this sense, aid has occasionally had limited success. However, aid cannot, and has not, contributed to the solution of economic problems and therefore economic growth. In this much more important sense, aid has failed," (p.392).

Skarbek, David and Peter T Leeson, 2009, "What Can Aid Do?" Cato Journal 29(3): 391-397